Design-led jewelry startup Lucira Jewelry has raised $5.5 million (approx. ₹46 crore) in a seed round, which the company said is the largest ever for a jewelry startup in India.

The round was led by Blume Ventures and Spring Marketing Capital, with participation from SiriusOne Capital Fund and several prominent angel investors, including founders of Dot & Key, Livspace, Snitch, and Bewakoof.

Growth Plans and Market Focus

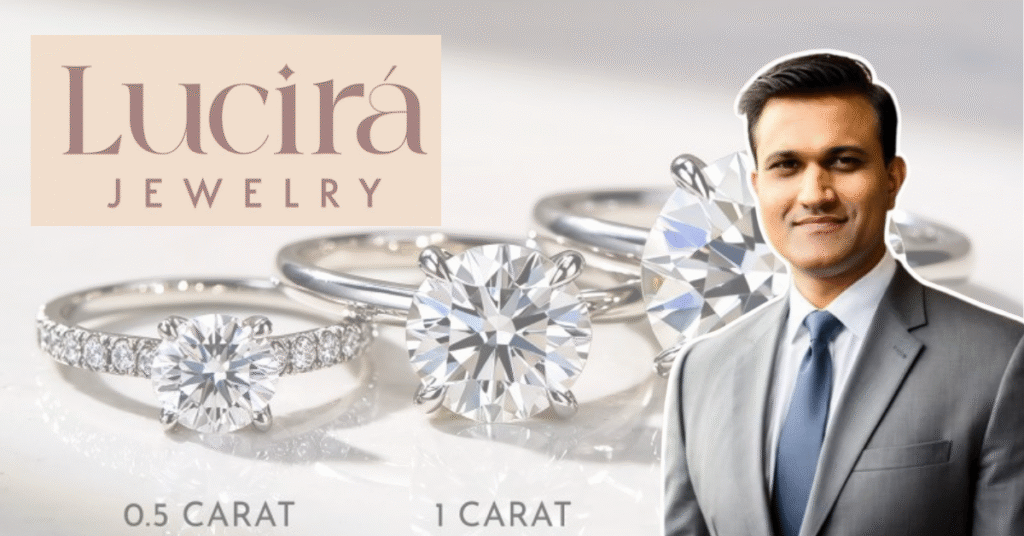

Lucira, founded by Rupesh and Vandana Jain, specializes in lab-grown diamond and recycled gold jewelry. The company plans to utilize the fresh capital to:

- Open five flagship retail stores across India by FY2026, starting with Mumbai this month.

- Expand its design studio to accelerate product innovation.

- Invest in technology and hiring to strengthen its omnichannel presence.

Lucira currently offers over 1,000 customizable designs certified by IGI, GIA, SGL, and BIS, while providing lifetime exchange and buyback guarantees.

Founder’s Edge and Investor Backing

Co-founder Rupesh Jain, who previously founded Candere (acquired by Kalyan Jewellers in 2017), said Indian consumers are shifting away from jewelry solely as an investment. “They are seeking design, authenticity, and relatable brands,” he noted.

Blume Ventures’ managing partner Karthik Reddy highlighted Lucira’s ability to merge digital-first shopping experiences with physical retail, backed by Jain’s proven expertise.

Sector Momentum

India’s jewelry startup ecosystem has seen rising investor interest, particularly in lab-grown diamonds and demi-fine jewelry. Recent rounds include Aukera ($15 million, Peak XV Partners), Firefly Diamonds ($3 million, WestBridge Capital), and Jewelbox ($3.2 million, V3 Ventures), reflecting a surge of capital into sustainable and design-driven jewelry brands.

Final Take

Lucira’s record-setting round underscores how consumer preferences, sustainability, and innovation are reshaping India’s fine jewelry market, with lab-grown diamonds emerging as a key growth driver.

Stay curious. Stay ambitious. Stay connected with StartupStoryindia.