Creative solutions firm Wit & Chai Group has closed its seed funding round at a valuation of Rs 40 crore. While the investment amount remains undisclosed, the round saw participation from leading industry figures including Rohan Vijay Mantri (Promoter, Mantri Landmarks), Sanjay Katkar (MD, Quickheal Technologies), Monish Darda (CTO & Co-Founder, Icertis), and Satyen Patel (MD, Sahyadri Industries).

Funding Snapshot

The fresh capital will be directed towards scaling Wit & Chai’s presence across global markets, expanding service verticals, and building proprietary intellectual property.

Strategic Roadmap

The company has outlined a three-pillar growth plan.

- Geographic Expansion: Strengthening its Mumbai base, scaling operations in London, and preparing entry into the UAE to serve international clients with greater agility.

- Service Diversification: Moving beyond campaign-led work to offer integrated brand experiences across digital and physical platforms, with a focus on B2B SaaS and enterprise clients.

- Acquisitions & IP Creation: Evaluating strategic acquisitions and developing proprietary formats such as Microdrama content and AI-powered creative tools aimed at redefining digital-first storytelling.

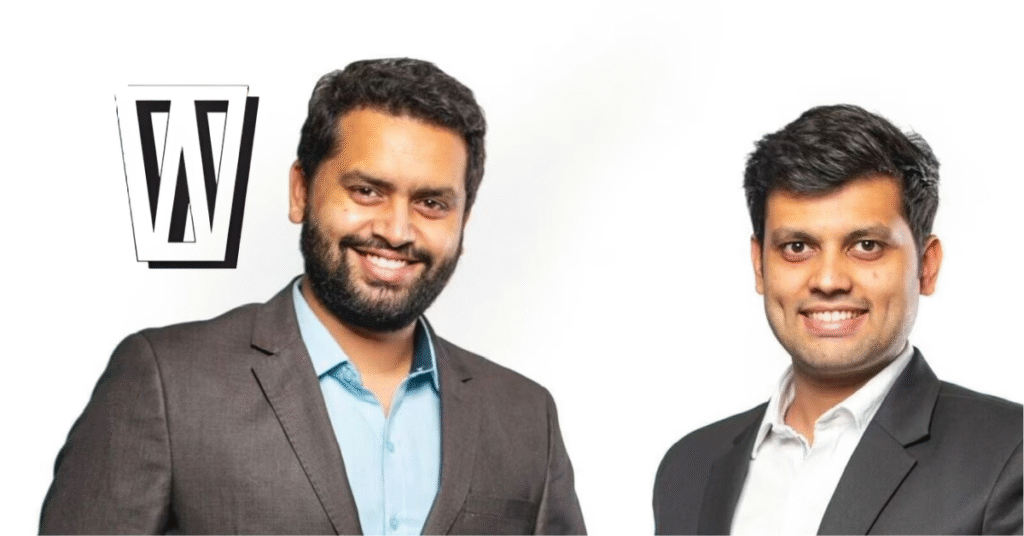

Founders’ Edge

Co-founder Nahush Gulawani emphasized that the funding marks a pivotal shift for the company. “This investment is not just capital – it’s fuel for our vision. Our focus now is threefold: expanding into global markets, unlocking new service verticals, and creating future-ready IPs that marry AI with storytelling,” he said.

Investor Satyen Patel added that Wit & Chai’s approach to blending creativity with technology positions it strongly in the evolving creative economy.

Market Watch

As brands increasingly seek tech-enabled, global-scale storytelling, Wit & Chai’s strategy to merge AI, creativity, and IP could position it as a new-age creative powerhouse from India with international impact.

Stay curious. Stay ambitious. Stay connected with StartupStoryindia